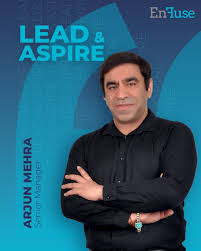

At the edge of Mumbai’s Churchgate station, people often remember a thin, scruffy boy who used to sit near the newspaper stand with curious eyes — his name was Arjun Mehra. What they didn’t know then was that this boy, who once begged for food, would one day become one of India’s most followed retail investors.

Humble Beginnings

Arjun lost both his parents in a bus accident when he was just 10 years old. With no relatives to take him in, he found himself sleeping on platforms, doing odd jobs, and reading discarded newspapers — especially the business section. It was there he first stumbled upon names like Rakesh Jhunjhunwala and Warren Buffett, sparking a lifelong obsession with the stock market.

First Step into the Market

By age 17, Arjun was working as a helper in a tea stall outside Dalal Street. He would listen quietly as traders spoke, memorizing stock names and ticker symbols. One kind trader noticed his curiosity and gifted him a second-hand smartphone and ₹500 to “try investing” on a mobile app.

He didn’t waste it.

Arjun studied the markets religiously. He joined free financial webinars, read blogs, and followed YouTube channels. His first investment was in a small-cap IT stock trading at ₹6. Within 8 months, it had doubled. But Arjun didn’t cash out. He reinvested, diversified, and gradually built discipline.

Turning Point

During the 2020 market crash, while most investors were panicking, Arjun saw it as an opportunity. He invested whatever he had saved in undervalued blue-chip and tech penny stocks. Over the next 3 years, those same stocks multiplied. What started as a few thousand turned into lakhs, and then crores.

By 2024, Arjun had made his first ₹100 crore.

Giving Back

Today, Arjun Mehra runs a successful investment firm that mentors underprivileged youth in financial literacy. He believes “information is the greatest equalizer” and shares his strategies openly on social media.

He lives in a modest apartment in Bandra, owns no luxury cars, and still walks into the same tea stall that gave him his first break — now as its proud co-owner.

💡 Key Lessons from Arjun’s Journey:

- 📘 Education over luck – He self-educated with free resources.

- ⏳ Patience pays – He didn’t rush profits.

- 📉 Crisis = Opportunity – He invested during crashes.

- 📊 Consistency > Capital – He started small but stayed consistent.

From a station platform to stock portfolios — Arjun Mehra’s journey proves that where you start doesn’t define where you’ll end up. 🚀